By understanding what is customer lifetime value (CLV), businesses can delve into the worth of every customer, not just for a single transaction but across the entire span of their relationship with the company. Beyond understanding their current spending habits, the lifetime customer value formula gives you insights into predicting future revenues, making it a cornerstone for informed business decisions.

So, why should businesses prioritise understanding their customers? Because every customer has a unique value, which is more than just their latest purchase. It's about forecasting their potential, adjusting strategies, and ultimately ensuring the business thrives in the long run. And the key to unlocking this potential? The customer lifetime value formula.

What is customer lifetime value?

At its core, customer lifetime value (CLV) is a metric that tells you the net profit you can expect to earn from a customer throughout their relationship with your business. But it's more than just a simple calculation. When you dive into what is customer lifetime value, you're tapping into a profound understanding of customer behaviour, engagement, and the long-term value they bring to your business table.

Let's break it down.

Imagine a customer who makes one purchase from your store and never returns. Now, compare them to another who buys smaller items but does so every month for several years. Using the lifetime customer value formula, you can determine that the latter — though making smaller purchases — has a higher CLV, indicating a deeper level of engagement and loyalty.

An increased CLV often signifies better customer engagement, enhancing business profitability. Engaged customers tend to buy more, advocate more, and remain loyal to your business.

Why is customer lifetime value important?

In essence, the importance of customer lifetime value formula stretches far and wide, influencing everything from day-to-day operations to long-term strategic planning. It's not just about understanding your customers' current value but forecasting their potential and sculpting strategies that cater to their evolving needs.

Firstly, consider the sheer economics of customer retention versus acquisition. It's a fact that it can cost up to five times more to acquire a new customer than to retain an existing one. By understanding and optimising the lifetime customer value formula, businesses can harness this economic efficiency, directing resources more judiciously.

A high CLV indicates that customers aren't just making one-off purchases but are continually engaged, coming back for more, and likely advocating for your brand. This repeated engagement is the bedrock of brand loyalty. When customers repeatedly choose you over competitors, it's a clear testament to the trust and value they associate with your brand.

Beyond just loyalty, CLV serves as a beacon for strategic budget allocations, especially when it comes to sales, marketing, and advertising. Knowing the lifetime value of a customer formula allows businesses to gauge the long-term revenue potential of their customer segments. This insight can be instrumental in determining where to invest more and where to scale back, ensuring that every penny spent is a step toward higher profitability.

What is the customer lifetime value formula?

The customer lifetime value formula is a sequence of calculations that distils the intricate nature of customer relationships into a singular, comprehensible figure. Before we dive into the formula itself, it's imperative to familiarise ourselves with the primary variables that make up this calculation:

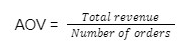

1. Average Order Value (AOV): This is the starting point. It represents the average amount a customer spends when they make a purchase. Simply put, it's the total revenue over a set period (often a year) divided by the number of purchases made.

This metric offers a snapshot of customer spending behaviour, but it's worth noting that it's an average. Different customers and seasons might show different spending patterns.

2. Purchase Frequency Rate (PFR): Now that we know how much, on average, a customer spends, we need to discern how often they open their wallets. This metric showcases the frequency of a customer’s transactions. To determine PFR, you'll take the total number of orders over your time frame and divide it by the number of unique customers.

Beyond just being a variable for our CLV calculation, PFR holds its own weight, indicating the stickiness of your product or service.

3. Customer Value (CV): This is where AOV and PFR come together in a harmonious blend. CV informs you about the revenue an average customer brings within a specific period. It’s the product of AOV and PFR.

CV = AOV × PFR

While CV provides an average, remember that the true value of each customer extends beyond just monetary terms. Loyalty, advocacy, and other intangible factors play a part, too.

4. Average Customer Lifespan (ACL): This is the tricky one, as it delves into predicting the future. ACL seeks to understand the duration for which a customer stays connected to your business. It's the average number of years a customer remains a patron. A simple way to calculate it involves taking the sum of customer lifespans and dividing it by the total number of customers.

Now, with these variables at hand, we can delve into the lifetime value of a customer formula: CLV = CV × ACL. Or, in more expanded terms: Customer Lifetime Value = Customer Value × Average Customer Lifespan.

How to calculate customer lifetime value?

Deciphering the lifetime value of a customer is like assembling a jigsaw puzzle. Each piece, from Average Order Value, to Purchase Frequency Rate, offers a glimpse into your customer's journey. Let's break down each of these components, using both formulas and examples to understand this essential metric.

1. Average Order Value (AOV)

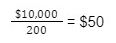

- Formula: AOV =

- Example: If you generated $10,000 from 200 orders last month, your AOV would be:

2. Purchase frequency rate (PFR)

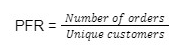

- Formula: PFR =

- Example: If those 200 orders came from 150 unique customers, then:

-min-1.png)

= 1.33. This means each customer, on average, purchased a little over once during the period.

3. Customer value (CV)

- Formula: CV = AOV × PFR

- Example: Using our earlier figures, the CV would be — CV = $50 × 1.33 = $66.50

4. Average customer lifespan (ACL)

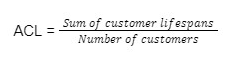

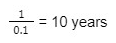

- Formula: ACL =

- Example: If 10% of your subscribers leave each year (a churn rate of 0.1), then: ACL =

5. Calculating customer lifetime value (CLV)

- Formula: CLV = CV × ACL

- Example: If our average customer's value is $66.50 and they stay with us for 10 years — CLV = $66.50 × 10 = $665. This is the worth of our average customer over their lifetime with our business!

How to increase your customer's lifetime value

Boosting the lifetime value of your customer isn't just a game of numbers; it's an art. Just like an artist hones their skills with practice, businesses too can refine their strategies to elevate the value of every customer.

1. Upsell

When customers are already invested, introducing them to higher-value products or services is both intuitive and effective. The lifetime value of customer formula surges when upselling is done right, as it provides customers with enhanced solutions they might not have realised they needed!

2. Focus on Satisfaction

It's not all about selling; it's about serving too. Stellar customer service not only retains customers but turns them into brand ambassadors. A satisfied customer will come back, increasing their individual customer lifetime value and potentially bringing new customers through word of mouth.

3. Discounts and Offers

Who can resist a good deal? Timely promotions serve as sweet spots in a customer's journey. They not only incentivise purchases but remind customers of the value they're getting, prompting them to stay engaged and loyal.

4. Loyalty Program

Now, here's a golden ticket. Reward systems for recurring customers work wonders. Whether it's a points system, exclusive discounts, or early access, showing appreciation for continued business magnifies the lifetime value of a customer. It's not just about transactions; it's about forming lasting relationships.

5. Keep in Touch

Consistent, relevant communication is more than just sending out newsletters. It's about understanding what your customers want to hear and when. Regular check-ins, product updates, or just a simple "We're thinking of you" can make a world of difference in how a customer perceives your brand.

6. Retention

Lastly, the magic word – retention. The longer a customer stays, the higher their value. But how do you ensure longevity? Personalisation. When customers feel like they're more than just a number, when their preferences and needs are catered to uniquely, that's when they stick around. In the end, increasing how to calculate the lifetime value of a customer becomes second nature when retention takes the front seat.

Increasing your customer's lifetime value isn't about one grand gesture. It's an amalgamation of consistent efforts, understanding, and delivering value at every step of the customer journey. It's a dance, and when orchestrated right, both you and your customers emerge winners.

Learn more about CLV with Feefo

Are your current customer engagement strategies truly maximising potential? Do they align with the insights offered by the customer lifetime value formula? Get in touch with our friendly team today to see how we can help you redefine your strategies to harness the potential of CLV.